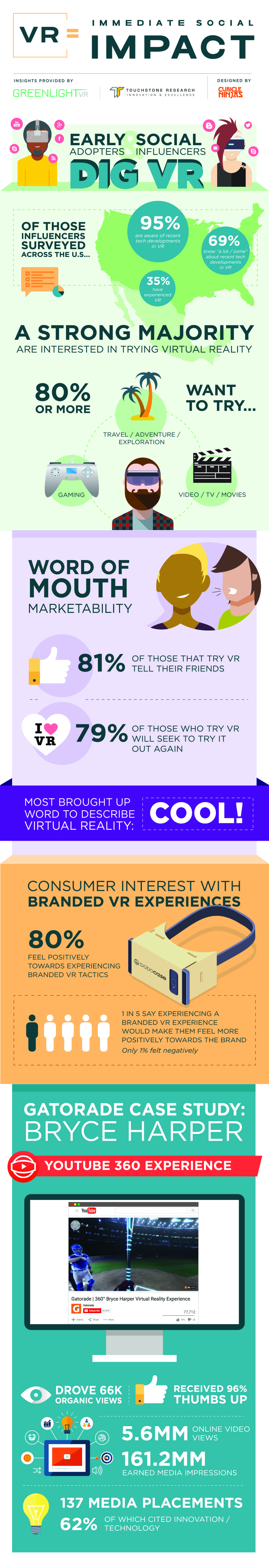

Advertising and marketing professionals looking to associate their brand with the excitement and promise of new technologies are going to want to take note of a comprehensive Virtual Reality Consumer Sentiment Survey of over 2,000 consumers that was recently conducted by Touchstone Research and Greenlight VR. When those who had experienced virtual reality (22% of the sample) were asked to describe their feelings about the experience, the most common words used were “cool” (a very strong top mention), “like”, “awesome”, “excited” and “fun”. Companies looking to identify their brand with these sorts of sentiments will benefit from associations with new virtual reality technologies. Additionally, the results discussed in the consumer report suggest strong word-of-mouth marketability and retention factors associated with virtual reality with 79% of consumers surveyed saying that they will seek out additional VR experiences and 81% of those who had already experienced virtual reality saying that they had told their friends about the experience.

The experience of virtual reality is most interesting and appealing to young people—tweens, teens and Millennials (ages 18-34)—but Touchstone Research and Greenlight VR reveal that the appeal extends far beyond that demographic. The sample included respondents age 10 though age 65+ with large bases in the following key generational groups: Generation Z (defined as ages 10-17 in the study), Millennials, Generation X (ages 35-50) and Baby Boomers (ages 51-69). While interest and appeal of VR does decline with age, there remains a substantial level of interest even among Baby Boomers (64% are positive towards VR and about half are interested). What and how people want to experience VR varies significantly by generation but there is a substantial proportion of every age group who are interested in the technology. Younger generations like Generation Z and Millennials will gravitate towards the gaming applications of VR technology while older individuals in Generation X and the Baby Boomers generation will gravitate towards the exploration and travel-based experiences that VR will create.

Tweens, teens and Millennials have a natural predisposition towards VR in that they are tech- savvy and gamers. As such, they are eager to experience the new technology and indicated a strong intent to purchase one of the new VR devices in 2016. Even more promising, on an unaided basis, 71% of Generation Z and 58% of Millennials described VR technology as “cool/fun/awesome”. These two age groups also are among the most enthusiastic toward virtual reality with 79% of Generation Z and 73% of Millennials rating it the top-two positive responses overall. Any brand looking to score with these vital segments will do well to familiarize themselves and embrace the excitement, fun and, most importantly, the game changing and disruptive potential of VR.

The young adults known as Millennials are a well-known and rising market force as they now outnumber Baby Boomers. The potential of this technology with Millennials is great and they are likely to be key in the initial adoption of virtual reality. It is Millennials, particularly, who see VR as the future with 20% indicating so on an open-end basis when asked about their thoughts on VR.

Another tremendously promising market segment is comprised of the tweens and teens of Generation Z and their parents. Generation Z is primed for new virtual reality devices and is excited, interested and highly motivated to embrace this new technology. They are an obvious potential customer base because they are early adopters and heavy users of technology and are already engaged in the sorts of activities that will be the first to be leveraged for virtual reality. They are a ripe target for the successful introduction of virtual reality products. To compound this, Generation Z’s parents are generally favorable towards virtual reality and the new devices and applications of the technology. Not only are parents largely open to (with important caveats) the idea of their children utilizing the new technologies, but they are also interested in experiencing VR themselves.

Other demographic trends in the awareness and enthusiasm for VR technology emerged between the different ethnic groups that were surveyed. Minorities were more passionate when it comes to VR. Generally speaking whites (non-Hispanic) are less aware of and interested in virtual reality than were blacks (non-Hispanic) and Hispanics who were stronger on measures involving awareness, interest and amount willing to pay. Hispanics were especially enthusiastic. For marketers and advertisers, here lies a large opportunity to cater to these segments in a more meaningful way.

While the majority of consumers are aware of virtual reality, few have a significant degree of familiarity with VR. Nonetheless, interested consumers seem to “get VR” and all of the potential of the technology. In general, consumers are especially interested in VR content and experiences that maximize on the immersive 3D virtual world available with VR. Such applications leverage the fantasy of the experience by allowing people to safely enjoy and participate in things that were previously only possible in dreams. The new experience created in virtual reality that has the greatest breadth of appeal is Travel/Exploration & Adventure. This is a natural fit with VR in that people are able to virtually immerse themselves in another environment and enjoy the fantasy of experiencing other lands, people and adventures. The idea of being able to virtually experience foreign lands, visit tourist destinations, and engage in explorations and adventures that might not be physically or otherwise possible strongly resonates with people of all ages.

Similarly, the genre of virtual Gaming that has an appeal which cuts across various consumer segments is racing. As with the Travel/Exploration & Adventure category of VR, consumers intuitively sense that VR racing games have the potential to take full advantage of the power of VR—they can virtually put the players into the vehicle, allowing them to experience the fantasy of being a professional driver, test their skills and provide the challenge of racing against other people–all in a realistic, fully immersive and thrilling way.

The overwhelming top choice for interactive VR Video/TV/Movies content is Action/Adventure (60%). The action genre has a large impact, is full of non-stop high energy and has lots of physical stunts. Additionally, this genre of VR contains activities with numerous exciting events such as chase scenes, battles, destructive disasters, fights and escapes. The appeal of the genre is in immersing yourself in the action from the hero/protagonist’ point-of-view and joining in their struggle to overcome great odds, danger and evil villains. Here, again, consumers understand that experiencing this genre in a fully immersive, 3D environment with 360 degree sound and video could be very powerful. Brands and messaging that take a similar approach in utilizing VR in “best fit” scenarios and creating VR ad content that maximizes the power and appeal of the medium will likely return dividends by breaking through 2D clutter and delivering a compelling experience for the brand’s target audience.

We identified a group of individuals within the sample (across the spectrum of ages and other demographics) who are technology influentials or opinion leaders. This small group of opinion leaders shapes the opinions, and ultimately the purchases, of the majority. Technology influentials are people who are active and involved in technology by seeking information and being interested in and highly knowledgeable on the topic. They are individuals with a large social network who express their opinions about technology/electronics products. In turn, those opinions are valued by the people they share it with. Almost all the technology influentials are aware of recent technological developments in VR (95%) with 69% knowing “a lot/some” about those recent developments and 35% having experienced VR. A strong majority of these technology opinion leaders are interested in trying virtual reality across all categories/activities asked about. 80% or greater want to try VR in categories such as Gaming, VR Video/TV/Movies, VR Travel/Adventure/Exploration and VR Architecture/Home design. The rank-order top activity that technology opinion leaders most want to do in virtual reality is VR Gaming—a clear first choice.

Another important quality of tech opinion leaders is that they are willing to pay more for a VR system than others and an impressive 85% indicated that they were likely to buy a virtual reality headset/device. The survey data indicates that the technology influentials have not made a hard decision on which VR platform they will buy (there is overlap between the alternatives). However, they did express a greater likelihood of buying a game system connected device (e.g. Sony’s PlayStation VR) with 66% saying they are “definitely/probably” likely to buy one, followed by 58% for a Smartphone wearable device (e.g. Samsung VR), 55% for a VR device connected to a computer (e.g. Oculus Rift) and 53% for a Smartphone hand held VR device (e.g. Google Cardboard). Unlike other consumers, tech influentials did not rate “price” as the most important factor in their purchase decision—to them, the quality of the product is the most important factor (70% said it was an “extremely important” factor).

Prior VR experience ranged from people who experienced VR on older ‘90s systems to current VR trials at theme parks, museums, demos at gaming conventions, trade shows, auto shows, electronics events, other conventions and the like. Those who have had experience with one of the new VR headsets ranged from 5-6% for each of the major brands (Oculus Rift, Playstation VR, Samsung Gear VR, and Gooogle Cardboard).

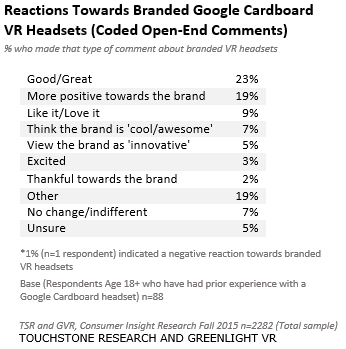

Five percent (5%, N=114 survey participants) of the sample had experienced Google Cardboard. Google Cardboard is essentially an inexpensive cardboard VR headset with lenses that allows for a smartphone to be inserted and people can view VR. It is more limited, of course, than game system based headsets and PC based headsets, nonetheless, it can provide a compelling VR experience. From a branding perspective, Google Cardboard has the option of being branded with your own logo/brand/styling and there are companies, such as DODOcase, that specialize in doing this. In the survey, those who had experienced Google Cardboard were asked how they would feel about a brand if they received a branded Google Cardboard headset as part of a marketing or promotional event and on an unaided basis most commented positively (only 1% made a negative comment), with 23% specifically saying that it would make them feel ‘good/great’ and 19% that they would feel more positively towards the brand. This, and further collaborative endeavors with other device manufacturers may be another way in which marketers and advertisers can be associated with what could be the most disruptive technology since the smartphone.

There are no clear front runners in terms of the VR headsets and types of platforms. At this time the options are as follows: VR headsets that connect to a computer (e.g. Oculus Rift), VR headsets that connect to a gaming system (e.g. Sony’s PlayStation VR), wearable interactive VR headsets that utilize a smartphone (e.g. Samsung Gear VR) and handheld VR headsets that utilize a smartphone (e.g. Google Cardboard). PlayStation VR has a small advantage in that it is an established brand, resulting in its slightly higher awareness and among the key segments that are likely to be early adopters such as tweens/teens, gamers and Millennials VR headsets that connect to a gaming system garner the most interest. Notwithstanding, it is clear that despite their purchase interest, most consumers have not decided on either a platform (they are interested in more than one) or a brand (only 20% said they were interested in a particular brand and even among this group they were interested in more than one brand).

Virtual reality and the new devices that will carry it into our homes is not without its challenges. First and foremost, pricing may be an issue for buyers. While those who are the most eager for VR are willing to pay more, this is not the case across a large proportion of the population. 65% said that price was an “extremely important” factor in their decision of whether to buy one of the new VR devices due to become available in 2016. Additionally, when asked if they had any concerns about VR, half (52%) did mention some sort of apprehension in the new technology. The most frequently discussed concerns were health related (23%) and “losing touch with the real world” (11%). Furthermore, 20% said getting “dizzy/sick” and 16% said being “afraid of getting injured” was a “very big concern” that would impact their decision to buy one of the new devices. The VR firms will need to do work to alleviate these concerns. As shown in the study, consumers will look to obtain knowledge about the products and seek out first-hand experiences in VR. It will be up to the VR companies to deliver to the promise.

Check out the VR Consumer Sentiment Infographic Below:

13 Comments